If you’re a serving NYSC corps member wondering Which Site Borrows Nysc Money—meaning platforms that lend funds tailored to corpers’ needs—the top options include YouthCred, WEMA Bank, Princeps Finance’s Corper Wallet, Moniestack, Irorun, GTBank’s Computer Acquisition Scheme, Credicorp’s YouthCred program, and Fidelity Bank’s NYSC Loan.

These sites and apps provide quick access to loans ranging from ₦5,000 to ₦5,000,000, often with low interest rates and flexible repayment terms aligned with your monthly allowance. In this guide, we’ll break down everything you need to know to make an informed choice.

Understanding NYSC Loans: What They Are and Why They Matter

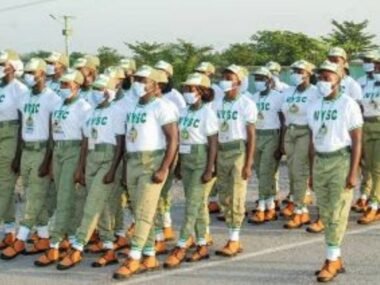

Serving in the National Youth Service Corps (NYSC) is a rite of passage for many Nigerian graduates, but it comes with its share of financial challenges. Your monthly allowance, often called “allawee,” might cover basics, but unexpected expenses like relocation costs, skill acquisition courses, or even starting a small side hustle can stretch it thin. That’s where NYSC loans come in. These are specialized financial products designed exclusively for corps members, offering borrowed funds without the usual hassles of traditional banking.

Unlike regular personal loans, NYSC-specific loans consider your unique situation: a fixed but modest income, a one-year service period, and often no extensive credit history. Banks and fintech platforms have stepped up to fill this gap, partnering with NYSC or creating dedicated schemes. For instance, recent initiatives like the Credicorp and NYSC collaboration have made headlines for providing up to ₦200,000 at single-digit interest rates. This isn’t just about borrowing money—it’s about building financial literacy and credit scores for life after service.

Why do corpers turn to these loans? Surveys and reports show that many struggle to make ends meet, with some even taking loans just to survive the month. Whether it’s buying a laptop for remote work, funding a certification course, or covering transportation to your Place of Primary Assignment (PPA), these loans provide a lifeline. But remember, borrowing should be a last resort after budgeting wisely.

The Benefits of Taking an NYSC Loan

Opting for an NYSC loan can be a game-changer during your service year. First off, accessibility is key—these loans often require minimal documentation, like your NYSC ID card, BVN, and proof of service, making them easier to get than standard bank loans. Approval times are lightning-fast, sometimes within minutes, which is perfect when you’re dealing with urgent needs.

Another big plus is the tailored repayment structure. Most platforms sync repayments with your allawee cycle, deducting installments automatically to avoid defaults. Interest rates are generally lower than those from loan sharks or informal lenders, often in the single digits or 3-5% monthly, helping you avoid debt traps.

Beyond immediate cash, these loans help build your credit history. Platforms like YouthCred emphasize financial education, requiring you to complete courses before borrowing, which equips you with skills for long-term financial health. In a country where youth unemployment is high, having a positive credit record can open doors to bigger loans or jobs post-NYSC.

Finally, some schemes offer extras, like the GTBank Computer Acquisition Scheme, which specifically funds gadget purchases, or Allawee’s credit-building card in partnership with Mastercard. These perks make borrowing not just about survival but about investing in your future.

Which Site Borrows Nysc Money

Now, let’s dive into the specifics. Based on current offerings, here are the leading platforms where corpers can borrow money. I’ve prioritized those with NYSC-specific products, low barriers, and positive user feedback.

1. YouthCred (youthcred.com)

YouthCred stands out as a fintech platform built for young Nigerians, with exclusive deals for NYSC members. They focus on “learn and borrow,” combining loans with credit education.

- Loan Amounts: From ₦5,000 to ₦5,000,000, scaling with your credit profile.

- Interest Rates: Low rates (exact figures vary, but emphasized as fair and transparent).

- Repayment Terms: 1 to 12 months, flexible with auto-debit options.

- Eligibility: Active NYSC service; complete a digital credit course.

- Application Process: Head to app.youthcred.com, fill out a quick form, get verified, and receive funds in minutes.

Pros: Builds credit knowledge; no hidden fees. Cons: Requires course completion, which might delay urgent needs. Ideal for corpers looking to borrow responsibly while learning.

2. WEMA Bank NYSC Loan (wemabank.com)

WEMA Bank, a longstanding Nigerian institution, offers a dedicated NYSC loan for quick financing. It’s great if you already bank with them.

- Loan Amounts: Not specified publicly, but flexible based on needs.

- Interest Rates: Competitive, often single-digit.

- Repayment Terms: Aligned with your service period, up to 12 months.

- Eligibility: Serving corper with a WEMA account; basic ID like BVN.

- Application Process: Apply via their app or branch; fast approval for account holders.

Pros: Reliable bank backing; integration with existing accounts. Cons: Might require in-person visits for some. Best for corpers in urban areas with WEMA branches.

3. Corper Wallet by Princeps Finance (princepsfinance.com)

Princeps Finance’s Corper Wallet is a no-collateral loan aimed at supporting NYSC dreams, like starting a side business.

- Loan Amounts: Up to ₦100,000.

- Interest Rates: Monthly rates start low (subject to risk assessment).

- Repayment Terms: Monthly, over the remaining service months.

- Eligibility: NYSC member with >2 months to POP; valid ID and salary account.

- Application Process: Online portal submission; review and disbursement in <24 hours.

Pros: Quick disbursement; no collateral. Cons: Cap at ₦100,000 might not suffice for larger needs. Suited for short-term boosts.

4. Moniestack NYSC Loans (moniestack.com)

Moniestack provides instant loans via WhatsApp and app, making it super convenient for tech-savvy corpers.

- Loan Amounts: ₦30,000 to ₦300,000, based on creditworthiness.

- Interest Rates: Transparent, no hidden charges.

- Repayment Terms: Flexible, customizable to income.

- Eligibility: NYSC ID, proof of service, valid ID.

- Application Process: Sign up at app.moniestack.com, submit docs, instant approval.

Pros: WhatsApp integration for ease; quick funds. Cons: Higher amounts require stronger credit. Great for remote corpers.

5. Irorun Loan App (irorun.com)

Irorun is a popular app listed among the best for corpers, offering small to medium loans with low rates.

- Loan Amounts: ₦5,000 to ₦50,000.

- Interest Rates: 3%–5% monthly.

- Repayment Terms: Monthly, up to 6 months.

- Eligibility: Serving corper; basic verification.

- Application Process: Download the app, apply digitally.

Pros: Low interest; fast app-based process. Cons: Smaller limits. Perfect for minor expenses like transport.

6. GTBank Computer Acquisition Scheme (gtbank.com)

If you need tech gadgets, GTBank’s scheme is targeted at corps members with domiciled allowances.

- Loan Amounts: Enough for computers/laptops (specifics vary).

- Interest Rates: Affordable, bank-standard.

- Repayment Terms: Time loan over the service year.

- Eligibility: Allowance account with GTBank; serving corper.

- Application Process: Apply at a branch or online.

Pros: Purpose-specific for productivity tools. Cons: Limited to gadget purchases. Ideal for digital nomads in NYSC.

7. Credicorp YouthCred Program (credicorp.gov.ng)

This government-backed scheme, in partnership with NYSC, is one of the most exciting recent developments.

- Loan Amounts: Up to ₦200,000 (phase 1), potentially more later.

- Interest Rates: Single-digit.

- Repayment Terms: Flexible, with incentives for early payment.

- Eligibility: Complete credit education course; active corper.

- Application Process: Through the NYSC portals or the Credicorp app.

Pros: Low rates; educational component. Cons: New program, might have teething issues. Best for long-term planners.

8. Fidelity Bank NYSC Loan (fidelitybank.ng)

Fidelity offers instant loans via digital channels for corpers.

- Loan Amounts: Instant, based on needs.

- Interest Rates: Competitive.

- Repayment Terms: Short-term, auto-deduct.

- Eligibility: Serving member; digital verification.

- Application Process: USSD (77008#), app, or WhatsApp.

Pros: Multiple access points. Cons: Details are sparse online. Good for quick cash.

Other mentions include NYSCLOANS.com.ng (₦20,000-₦200,000, flexible) and apps like KopAdvance or Allawee for niche needs.

How to Choose the Right Site for Your NYSC Loan

With so many options, picking the best site depends on your needs. For large amounts, go with YouthCred or Credicorp. For quick, small loans, Irorun or Moniestack. If you want bank security, WEMA or Fidelity. Compare using this table:

| Site/App | Max Amount | Interest Rate | Repayment | Best For |

|---|---|---|---|---|

| YouthCred | ₦5,000,000 | Low | 1-12 months | Education + Loan |

| WEMA Bank | Flexible | Single-digit | Up to 12 mo | Bank customers |

| Corper Wallet | ₦100,000 | Varies | Monthly | No collateral |

| Moniestack | ₦300,000 | Transparent | Custom | Instant access |

| Irorun | ₦50,000 | 3-5% mo | Up to 6 mo | Small needs |

| GTBank | Gadget-specific | Affordable | Service year | Tech purchases |

| Credicorp | ₦200,000 | Single-digit | Flexible | Government-backed |

| Fidelity | Instant | Competitive | Short-term | Digital apply |

Always check current terms, as they can change.

Eligibility Criteria for NYSC Loans

Most platforms share similar requirements:

- Be a current NYSC corps member.

- Have a valid NYSC ID card.

- Provide BVN and a valid ID (NIN, voter’s card).

- Have a bank account (often where allowance is paid).

- Sometimes, proof of PPA or remaining service time (>2 months).

For government schemes like YouthCred, a credit course is mandatory. No guarantors or collateral for many fintechs, but banks might ask for account history.

Interest Rates, Fees, and Repayment Terms Explained

Interest rates hover around 3-10% monthly, lower than payday loans. For example, Irorun’s 3-5% is attractive for short terms. Repayments are typically monthly, deducted from your account to match allowance payments. Late fees apply, so plan. Some offer grace periods or extensions.

Hidden fees? Reputable sites like those listed avoid them, but always read the terms. For Credicorp, it’s single-digit with no surprises.

Pros and Cons of Borrowing NYSC Money

Pros:

- Quick cash for emergencies.

- Builds credit.

- Flexible terms.

- Educational benefits.

Cons:

- Risk of debt if not managed.

- Interest adds cost.

- Limited to the service year.

- Potential for scams—stick to verified sites.

Alternatives to NYSC Loans

Before borrowing, consider:

- Side hustles: Freelancing or small businesses.

- Savings: Budget allawee better.

- Grants: NYSC skill programs or FG youth funds.

- Family support or cooperative societies.

- Credit cards, like Allawee’s, can help build credit without loans.

Tips for Responsible Borrowing During NYSC

- Borrow only what you need and can repay.

- Compare multiple options.

- Read reviews on forums like Reddit or NYSC Facebook groups.

- Use loans for productive purposes, not luxury.

- Track repayments with apps.

- Build emergency savings post-loan.

- Avoid multiple loans to prevent over-indebtedness.

Remember, financial habits formed now last a lifetime.

Frequently Asked Questions (FAQs): Which Site Borrows Nysc Money

Q: Can I get an NYSC loan without a guarantor? A: Yes, most fintechs like Moniestack don’t require one.

Q: What’s the maximum I can borrow? A: Up to ₦5,000,000 via YouthCred, but start small.

Q: Are these loans safe? A: Stick to regulated platforms; avoid unverified apps.

Q: How long does approval take? A: Minutes to 24 hours for most.

Q: Can I repay early? A: Yes, often with credit boosts.

Q: What if I default? A: It hurts your credit; communicate with lenders.

Q: Are there loans for post-NYSC? A: Some transition to general loans.

Q: How do I apply for the FG’s ₦5 million youth loan? A: NYSC members are eligible; check Credicorp for details.

Conclusion: Which Site Borrows Nysc Money

Navigating NYSC on a tight budget doesn’t have to be stressful. Sites like YouthCred, Moniestack, and Credicorp make borrowing NYSC money straightforward and beneficial, provided you approach it wisely. By choosing the right platform, understanding terms, and borrowing responsibly, you can turn financial hurdles into stepping stones.

Always verify current details on official sites, and focus on building a strong economic foundation for the future. If you’re a corper reading this, what’s your experience with these loans? Share in the comments to help others.