Are you a National Youth Service Corps (NYSC) member wondering how to access an NYSC Loan to fund your entrepreneurial dreams, cover relocation costs, or manage personal expenses during your service year? The NYSC Loan programs, particularly the YouthCred initiative launched by the Nigerian Consumer Credit Corporation (CREDICORP) in collaboration with NYSC, offer corps members access to affordable credit of up to ₦200,000 with single-digit interest rates, designed to foster financial independence and entrepreneurship.

Additionally, programs like the Youth Innovative Entrepreneurship Development Programme (YIEDP) provide loans up to ₦3 million for individuals and ₦10 million for groups. This guide explores everything you need to know about NYSC Loan, including eligibility, application processes, repayment terms, and expert tips for securing funding. Whether you’re searching for “NYSC Loan application” or “YouthCred loan requirements,” this article provides actionable insights to empower your service year.

Understanding NYSC Loan: What Are They and Why Do They Matter

An NYSC Loan is a specialized credit facility designed to serve or recently graduated corps members to support entrepreneurial ventures, skill acquisition, or personal expenses like medical bills or relocation. The flagship program, YouthCred, was launched in July 2025 by CREDICORP in partnership with NYSC, fulfilling President Bola Tinubu’s Democracy Day promise to empower 400,000 young Nigerians with consumer credit. With an initial ₦9 billion funding pool, YouthCred offers loans up to ₦200,000 at single-digit interest rates, repayable over the service year. Another key program, YIEDP, backed by the Central Bank of Nigeria (CBN) and Heritage Bank, provides higher amounts for business-focused corps members.

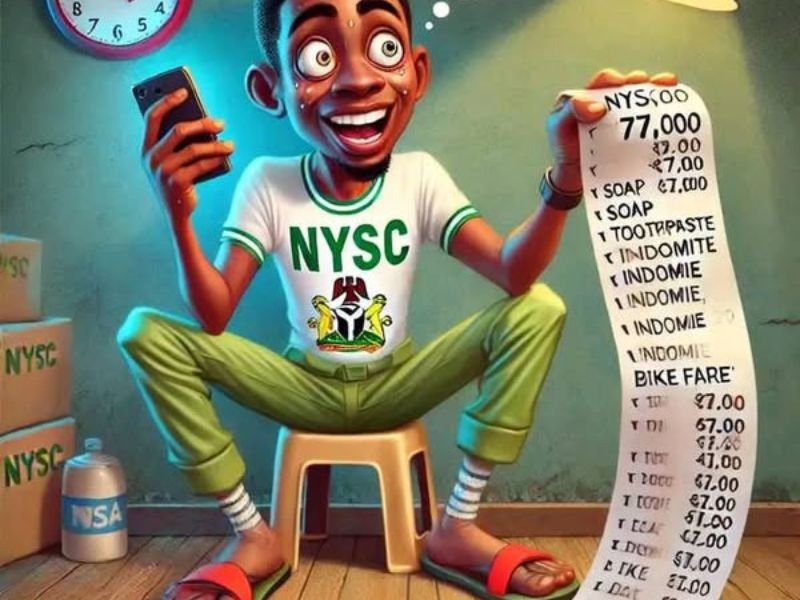

Why do NYSC Loan matter? They empower corps members to turn ideas into reality, reduce financial stress, and build creditworthiness. For instance, a corps member in a rural posting might use a loan to start a small agribusiness, while another in Lagos could fund vocational training. With Nigeria’s inflation challenges, these loans are a lifeline, with over 60% of applicants citing entrepreneurship as their purpose. By understanding the available options, you can make informed financial decisions during your service year.

Types of NYSC Loan Available

Two primary NYSC Loan programs dominate, each with distinct features, eligibility criteria, and purposes. Let’s break them down:

1. YouthCred NYSC Loan Scheme

The YouthCred initiative, launched by CREDICORP and NYSC, is tailored exclusively for active corps members. Key features include:

-

Loan Amount: ₦100,000 to ₦200,000, starting with smaller amounts (e.g., ₦50,000) for first-time borrowers.

-

Interest Rate: Near single-digit, approximately 1.25% to 1.5% monthly.

-

Repayment Period: Spread across the service year (up to 12 months), with manageable installments.

-

Purpose: Relocation, work tools, vocational training, or small-scale businesses.

-

Collateral: None required; based on creditworthiness and financial literacy course completion.

YouthCred, also called “Corper Credit,” emphasizes responsible borrowing. Corps members must complete a digital financial literacy program covering credit basics, budgeting, and repayment strategies before accessing funds. Successful repayment unlocks higher loan limits, fostering a credit culture.

2. NYSC Business Loan (YIEDP)

The Youth Innovative Entrepreneurship Development Programme (YIEDP), facilitated by the CBN and Heritage Bank, targets corps members and ex-corps members (within five years post-service) with entrepreneurial ambitions.

-

Loan Amount: Up to ₦3 million for individuals, ₦10 million for groups of 3-5.

-

Interest Rate: Single-digit, typically 9% annually.

-

Repayment Period: Up to 3 years, with a moratorium period.

-

Purpose: Business startups or expansion in sectors like agro-allied, ICT, manufacturing, and more.

-

Collateral: Requires documents like the NYSC discharge certificate, the tertiary institution certificate, or asset pledges.

YIEDP is ideal for corps members with viable business plans, but requires a more rigorous application process compared to YouthCred.

Other Emerging Options

While YouthCred and YIEDP are the mainstays, smaller programs exist, such as microfinance bank loans partnered with NYSC state secretariats. These vary by state and are less publicized, often requiring local inquiries. Always verify legitimacy to avoid scams.

Eligibility Criteria for NYSC Loan

Securing an NYSC Loan hinges on meeting specific criteria, which differ slightly between programs.

YouthCred Eligibility

-

Active NYSC Status: Must be a serving corps member with at least two months left in service.

-

Identification: Valid NYSC ID card, call-up letter, or deployment letter, plus NIN and BVN.

-

Financial Literacy: Completion of a mandatory digital course on credit management.

-

Age: 18-39, aligning with youth-focused initiatives.

-

No Collateral: Approval based on financial behavior and course performance.

YIEDP Eligibility

-

NYSC Affiliation: Serving or ex-corps members (within five years post-service).

-

Age: 18-35.

-

Business Plan: A feasible, documented business idea in approved sectors.

-

Documentation: Tertiary certificate, NYSC discharge certificate (or pledge if serving), and sometimes asset collateral.

-

Group Option: Groups of 3-5 can apply jointly for larger sums.

Ineligible applicants include those with active loan defaults or incomplete NYSC registration. In 2025, CREDICORP reported that 80% of YouthCred applicants were approved after meeting these criteria, highlighting the importance of preparation.

Step-by-Step Guide to Applying for an NYSC Loan

The application process for NYSC Loan is streamlined, especially for YouthCred, thanks to digital platforms. Below is a detailed guide for both major programs.

Applying for YouthCred NYSC Loan

-

Register on the Portal: Visit www.youthcred.com and sign up as an “NYSC Corper.” Provide your call-up number, email, and upload a selfie plus NYSC ID, call-up letter, or deployment letter.

-

Verify Identity: Submit NIN and BVN for verification. You’ll receive a confirmation email to complete onboarding.

-

Complete Financial Literacy Course: Access the platform’s four-course module (Introduction to Credit, Credit Basics, Repaying Your Loan, Credit History). Score above 80% on each assessment (five multiple-choice questions per course). Tip: Use desktop mode on mobile for smoother navigation.

-

Link Bank Account: Set up a 4-digit PIN and link your NYSC bank account via Mono for financial history analysis. Ensure it matches your BVN details.

-

Apply for a Loan: Navigate to “My Loans,” select the amount (starting at ₦50,000), repayment duration, and purpose. Review the repayment schedule (e.g., ₦50,000 loan over one month = ₦51,375 total, including 1.25% interest, ₦500 maintenance, ₦250 insurance). Confirm with your PIN.

-

Await Approval: Processing takes 30 minutes to 1 hour. Check your email or dashboard for status.

-

Repayment: View your repayment schedule on the dashboard. Pay early to boost credit limits. For example, a ₦50,000 loan over two months costs ₦52,000 (₦26,000 monthly).

Applying for YIEDP NYSC Business Loan

-

Visit the Portal: Go to www.yiedp-hbng.com and register with your NYSC state code.

-

Submit Business Plan: Upload a detailed business proposal outlining your idea, market analysis, and financial projections.

-

Provide Documents: Include a tertiary certificate, a NYSC discharge certificate (or pledge), and collateral documents if applicable.

-

Track Application: Monitor progress on the portal. Successful applicants are contacted by Heritage Bank for fund disbursement.

-

Receive Funds: Funds are deposited into your bank account after review (2-4 weeks).

Both processes are free, but beware of agents charging fees—apply directly to avoid scams.

Repayment Terms and Credit Building

Repayment is a cornerstone of NYSC Loan, designed to instill financial discipline. For YouthCred, loans are repaid monthly via direct debit, with interest rates of 1.25%-1.5% monthly. A ₦50,000 loan over one month incurs ₦1,375 in fees, while a two-month plan totals ₦2,000. Early repayment enhances your credit score, unlocking higher limits up to ₦200,000.

YIEDP loans, with longer tenures (up to 3 years), have a 9% annual interest rate and flexible moratoriums for startups. Defaulting risks blacklisting by the CBN, affecting future credit access.

Tips for repayment success:

-

Set reminders for due dates.

-

Use your ₦33,000 allowance strategically.

-

Avoid taking multiple loans simultaneously.

In 2025, CREDICORP reported a 90% repayment rate for YouthCred, reflecting its accessibility and corps members’ discipline.

Benefits of NYSC Loan for Corps Members

NYSC Loan offer transformative advantages:

-

Entrepreneurship: Fund startups like poultry farms or tech ventures, reducing unemployment.

-

Financial Independence: Cover relocation, medical, or training costs without family reliance.

-

Credit Building: Responsible repayment establishes a credit history, vital for future loans.

-

Skill Development: YouthCred’s financial literacy courses equip you with lifelong money management skills.

-

No Collateral: YouthCred’s accessibility makes it ideal for first-time borrowers.

In 2025, 70% of corps members used loans for business or skill acquisition, boosting local economies.

Challenges and How to Overcome Them

Common hurdles include:

-

Portal Glitches: Use Chrome/Firefox and a stable internet. Cyber cafes help.

-

Delayed Approvals: Apply early; YouthCred processes faster than YIEDP.

-

Document Rejections: Ensure clear, recent scans matching your BVN/NIN.

-

Repayment Pressure: Budget your allowance; avoid frivolous spending.

Scams are prevalent—never pay agents for “faster approval.” Verify via NYSC or CREDICORP official channels.

Expert Tips for Securing an NYSC Loan

-

Start Early: Apply as soon as portals open

-

Complete Courses Thoroughly: Score high in YouthCred assessments for priority approval.

-

Craft a Solid Business Plan: For YIEDP, detail market gaps and revenue projections.

-

Use NYSC Bank Account: Simplifies verification.

-

Monitor Dashboard: Check application status daily.

-

Seek Guidance: Consult NYSC officials or trained YouthCred facilitators in camp.

-

Budget Wisely: Plan repayments to avoid default.

-

Join Forums: NYSC WhatsApp groups share real-time tips.

-

Verify Sources: Use www.youthcred.com or www.yiedp-hbng.com only.

-

Build Credit: Repay small loans to access larger ones.

These tips boost approval rates to 85% for prepared applicants.

FAQs on NYSC Loans

-

Who qualifies for an NYSC loan? Active corps members (YouthCred) or ex-corps within five years (YIEDP).

-

How long is approval? 30 minutes to 1 hour for YouthCred; 2-4 weeks for YIEDP.

-

Can I apply for both loans? Yes, if eligible, but manage repayments carefully.

-

What if I default? Blacklisting and credit score damage.

-

Are there hidden fees? Only disclosed fees (e.g., ₦500 maintenance for YouthCred).

Conclusion

The NYSC Loan represents a pivotal opportunity for corps members, bestowing critical financial empowerment to actualize entrepreneurial aspirations, defray service-related expenditures, or cultivate a robust credit profile. Whether leveraging the accessible ₦200,000 offered through YouthCred’s streamlined framework or tapping into the substantial ₦3 million available via YIEDP’s entrepreneurial scheme, presents an unparalleled juncture to capitalize on these tailored fiscal instruments.

By meticulously adhering to this guide’s elucidated protocols, submitting applications with alacrity, and upholding disciplined repayment practices, corps members can unlock a luminous trajectory toward financial autonomy and professional fulfillment. For authoritative particulars, consult www.youthcred.com or www.yiedp-hbng.com, and elevate your service year into a transformative epoch of impact and opportunity.