With the development of innovative savings applications in recent years, Nigeria’s financial sector has undergone a tremendous shift. These apps have grown in popularity because they provide Nigerians with quick and accessible options to save and invest their money.

With so many savings applications available, it can be difficult to choose which one best fits your specific financial goals. We’ve produced a detailed list of the top 10 best savings apps in Nigeria, based on customer ratings, to help you make an informed financial decision.

Why More People Are Choosing Savings Apps In Nigeria?

- Savings applications provide a simple and convenient method to manage your funds from the convenience of your smartphone, saving you from the stress occasioned by long lines, paperwork, and time-consuming processes which are the hallmark of traditional banking in Nigeria.

- Savings applications are available to a wide spectrum of users, including those living in distant places where traditional banking services are unavailable. To begin, what you need is a good internet service and a smartphone.

- Savings applications help to increase financial inclusion by providing chances to people who may not have previously had access to banking services. They give users the ability to take control of their financial fate.

- Savings apps include a number of features, such as automated savings, investment opportunities, and more, allowing users to personalize their financial strategy to their individual needs.

List Of Best Savings Apps In Nigeria

Here is a list the best savings apps in Nigeria. Note that the list is generated and arranged based on the rating that users gave the apps on Google Play Store.

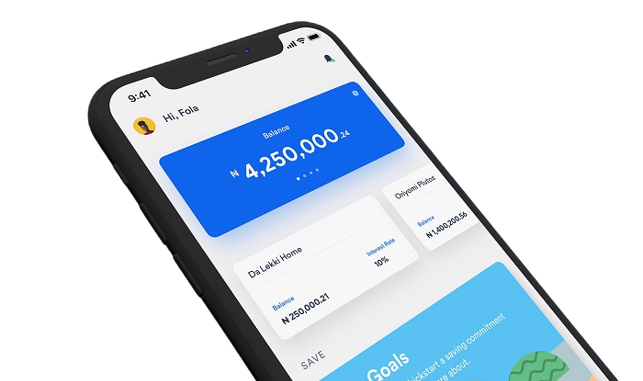

1. PiggyVest (4.6 stars)

Top of our list is PiggyVest. PiggyVest is a flexible savings and investment platform noted for its unique savings features. It has a 4.6-star rating on Google Play, making it one of the most popular savings apps in Nigeria. PiggyVest provides a variety of services, including as automated savings, fixed deposits, and investing options. Users love its simple layout and several savings possibilities.

You may create savings goals, invest in mutual funds, and earn attractive interest rates on your savings with PiggyVest. It’s a wonderful option for people who want to grow their savings and attain their financial goals.

2. Cowrywise (4.5 Stars)

This is yet another top-rated savings app in Nigeria, with 4.5 stars on Google Play. This software provides customizable savings plans, mutual funds, and investing options. Cowrywise is well-known for its easy-to-use interface and intuitive design. It enables users to define and track savings goals, making it easier to meet financial milestones. Cowrywise encourages individuals to take charge of their financial futures and develop their wealth over time by offering features such as automated savings and frequent investing possibilities.

3. ALAT By Wema (4.3 stars)

This is a digital bank that offers a variety of savings and investing opportunities. ALAT has a 4.3-star rating due to its simple account creation, savings objectives, and bill paying capabilities. Through its mobile app, ALAT allows customers to save, invest, and manage their finances with ease. Users can establish virtual debit cards, set specific savings goals, and enjoy a no-fee banking experience. ALAT is an excellent solution for people looking for a digital bank with strong savings capabilities.

4. Carbon Save (4.3 stars)

Carbon Save is an expansion of the famous Carbon platform that allows users to save money and earn interest on it. Carbon Save, which has a 4.3-star rating, is noted for its ease of use and accessibility. Users can create savings goals, earn interest on their accounts, and withdraw funds whenever they need them. Carbon Save is a fantastic choice for anyone looking for a simple savings solution from a reputable financial platform.

5. Kuda Bank (4.2 stars)

Kuda Bank is not only a digital bank but also a cutting-edge savings app. Kuda has a 4.2-star rating for its no-fee banking, fast transfers, and goal-based savings tools. Kuda mixes banking and savings to offer users a complete financial platform.

Users may use the app to create virtual debit cards, establish savings goals, and easily access their accounts. Kuda is a great alternative if you want a digital bank that streamlines banking while also providing powerful savings choices.

6. Trove (4.1 stars)

Trove is an investment platform that allows users to invest in stocks, bonds, and cryptocurrencies from across the world. Trove has a 4.1-star rating on Google Play for its investment diversity and user-friendly design. Trove enables people to increase their wealth by giving them access to a diverse choice of investment alternatives. Whether you’re a novice or an experienced investor, Trove provides a simple approach to begin creating your investment portfolio.

7. CashBox (4.0 stars)

CashBox is a savings platform that offers customers the opportunity to earn interest on their funds. CashBox has a 4.0-star rating on Google Play because of its ease of use and attractive interest rates. Users can set savings goals, receive interest on their investments, and withdraw funds as needed. For those wishing to earn more on their idle assets, CashBox provides a simple savings experience.

8. FINT (4.0 stars)

FINT is a savings and investing platform that enables users to save and invest in a wide range of asset types. FINT has a 4.0-star rating on Google Play because of its numerous investment alternatives and user-friendly design. FINT provides features like as automated savings, investment alternatives, and an easy-to-use interface. It’s an excellent option for people who want to diversify their savings and investments on a single platform.

9. Renmoney (3.9 stars)

Renmoney is a flexible financial platform that provides savings accounts in addition to loan services. It has received a 3.9-star rating on Google Play for its quick account creation and user-friendly layout. Renmoney offers people a secure and dependable way to save money while also giving reasonable interest rates. Renmoney has the tools to help you achieve your financial goals, whether you’re saving for a specific purpose or establishing an emergency fund.

10. Wealth.ng (3.9 stars)

Wealth.ng is yet another Nigerian savings and investing platform, offering a variety of investment alternatives, such as mutual funds and fixed income instruments. Wealth.ng has a 3.9-star rating on Google Play for its investing opportunities and educational services. It caters to both novice and experienced investors, providing a platform for them to grow and manage their wealth. The user-friendly interface of Wealth.ng makes it accessible to a wide range of people.

Final Thoughts

Keep in mind that your ideal savings app might not be the same as someone else’s. Your savings app of choice should be in line with your own financial condition, goals, and aspirations. There are a savings app in Nigeria that can help you make the most of your money, regardless of whether you’re saving for long-term aims like retirement or short-term goals like a trip.

Leave a Reply